In Friday’s reading, I mentioned Michael Lewis’s piece in Vanity Fair: When Irish Eyes Are Crying. It is your must read of the weekend.

The problems in Ireland makes the woes in Greece look merely like a bounced check. And Ireland’s eejit politicians, FOLLOWING THE ADVICE OF MERRILL LYNCH, turned the entire population of the Emerald Isle into indentured servants to bankers, guaranteeing all of their bad loans with taxpayer money.

Private gains, socialized losses indeed.

Here’s what makes this story so amazing. Merrill’s analyst warned about the Irish Bank problems in advance, he was fired for his troubles. The discussion about this is one of the more fascinating aspects of Lewis’ column. It reveals the firm as intellectually dishonest, spineless, toadies, wrapping their lips around the knob of every Irish banker regardless of consequence.

I read the next four paragraphs about Merrill Irish bank analyst Philip Ingram in sheer astonishment:

“The bank analyst who had been most prescient and interesting about the Irish banks worked for Merrill Lynch. His name was Philip Ingram. In his late 20s, and a bit quirky—at the University of Cambridge he had studied zoology—Ingram had done something original and useful: he’d shined a new light on the way Irish banks lent against commercial real estate.

The commercial-real-estate loan market is generally less transparent than the market for home loans. Deals between bankers and property developers are one-offs, on terms unknown to all but a few insiders. The parties to any loan always claim it is prudent: a bank analyst has little choice but to take them at their word. But Ingram was skeptical of the Irish banks. He had read Morgan Kelly’s newspaper articles and even paid Kelly a visit in his university office. To Ingram’s eyes, there undoubtedly appeared to be a vast difference between what the Irish banks were saying and what was really happening. To get at it he ignored what they were saying and went looking for knowledgeable insiders in the commercial-property market. He interviewed them, as a journalist might. On March 13, 2008, six months before the Irish real-estate Ponzi scheme collapsed, Ingram published a report, in which he simply quoted verbatim what British market insiders had told him about various banks’ lending to commercial real estate. The Irish banks were making far riskier loans in Ireland than they were in Britain, but even in Britain, the report revealed, they were the nuttiest lenders around: in that category, Anglo Irish, Bank of Ireland, and A.I.B. came, in that order, first, second, and third.

For a few hours the Merrill Lynch report was the hottest read in the London financial markets, until Merrill Lynch retracted it. Merrill had been a lead underwriter of Anglo Irish’s bonds and the corporate broker to A.I.B.: they’d earned huge sums of money off the growth of Irish banking. Moments after Phil Ingram hit the Send button on his report, the Irish banks called their Merrill Lynch bankers and threatened to take their business elsewhere. The same executive from Anglo Irish who had called to scream at Morgan Kelly called a Merrill research analyst to scream some more. Ingram’s superiors at Merrill Lynch hauled him into meetings with in-house lawyers, who toned down the report’s pointed language and purged it of its damning quotes from market insiders, including its many references to Irish banks. And from that moment everything Ingram wrote about Irish banks was edited, and bowdlerized by Merrill Lynch’s lawyers. At the end of 2008, Merrill fired him. One of Ingram’s colleagues, a fellow named Ed Allchin, was also made to apologize to Merrill’s investment bankers individually for the trouble he’d caused them by suggesting there was still money to be made on shorting Irish banks.

It would have been difficult for Merrill Lynch’s investment bankers not to know, at some level, that in a reckless market the Irish banks had acted with a recklessness all their own. But in the seven-page memo to Brian Lenihan—for which the Irish taxpayer forked over to Merrill Lynch seven million euros—they kept whatever reservations they may have had to themselves. “All of the Irish banks are profitable and well capitalised,” wrote the Merrill Lynch advisers, who then went on to suggest that the banks’ problem wasn’t at all the bad loans they had made but the panic in the market. The Merrill Lynch memo listed a number of possible responses the Irish government might have to any run on Irish banks. It refrained from explicitly recommending one course of action over another, but its analysis of the problem implied that the most sensible thing to do was guarantee the banks. After all, the banks were fundamentally sound. Promise to eat all losses, and markets would quickly settle down—and the Irish banks would go back to being in perfectly good shape. As there would be no losses, the promise would be free.”

So Merrill Lynch’s coverage of Irish banking, before the crisis, was dead on. And they threw their analyst under the bus to whore for more banking fees.

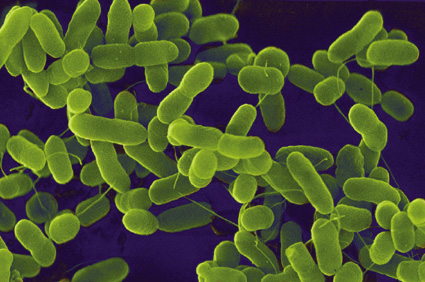

Cowards. Criminal toadies. Chickenshit pimps who would sell their mothers into forced prostitution for a buck. That is Merrill Lynch, and the fact that a single goddamned dollar of my tax money went to these spineless, money-grubbing parasites makes my stomach turn. If Goldman Sachs is a vampire squid, then Merrill Lynch is Escherichia coli of banking. Whatever they touch gets sick, and occasionally dies.

Cowards. Criminal toadies. Chickenshit pimps who would sell their mothers into forced prostitution for a buck. That is Merrill Lynch, and the fact that a single goddamned dollar of my tax money went to these spineless, money-grubbing parasites makes my stomach turn. If Goldman Sachs is a vampire squid, then Merrill Lynch is Escherichia coli of banking. Whatever they touch gets sick, and occasionally dies.

Think back to Merrill Lynch’s greatest hits: Bankrupting Orange County. The investment banking scandals in the 1990s. The Analyst scandals of the 2000s. The derivative disaster of CDOs. And now Ireland.

I’ve said this before, and I will repeat it here: If you are a Merrill Lynch client, and they lose you money, you have forfeited the right to complain to anyone — its your own damned fault. Anyone who gives money to these incompetent fools and weasels gets exactly what they deserve . . .

>

Source:

When Irish Eyes Are Crying

Michael Lewis

Vanity Fair, March 2011

http://www.vanityfair.com/business/features/2011/03/michael-lewis-ireland-201103?printable=true

What's been said:

Discussions found on the web: