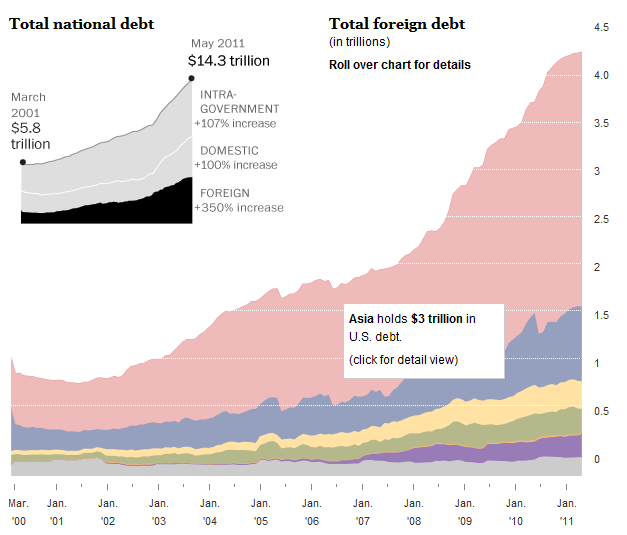

Click for full interactive graphic:

Hat tip: Flowing Data

Previously: Who Does the US Owe Money To?

Source:

Our Mountain Of Debt

Washington Post

Published July 17, 2011

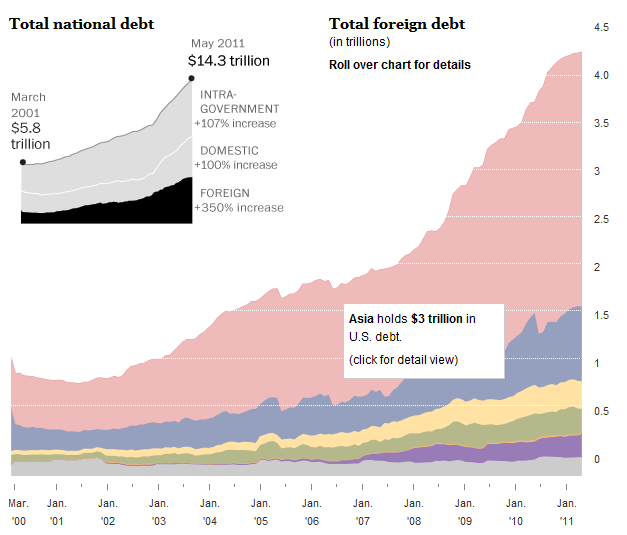

Click for full interactive graphic:

Hat tip: Flowing Data

Previously: Who Does the US Owe Money To?

Source:

Our Mountain Of Debt

Washington Post

Published July 17, 2011

Get subscriber-only insights and news delivered by Barry every two weeks.

What's been said:

Discussions found on the web: