Examining the big lie: How the facts of the economic crisis stack up

Barry Ritholtz

Washington Post, November 19

~~~

It’s fair to say that our discussion about the big lie touched a nerve.

The big lie of the financial crisis, of course, is that troubling technique used to try to change the narrative history and shift blame from the bad ideas and terrible policies that created it.

Based on the scores of comments, people are clearly interested in understanding the causes of the economic disaster.

I want to move beyond what I call “the squishy narrative” — an imprecise, sloppy way to think about the world — toward a more rigorous form of analysis. Unlike other disciplines, economics looks at actual consequences in terms of real dollars. So let’s follow the money and see what the data reveal about the causes of the collapse.

Rather than attend a college-level seminar on the complex philosophy of causation, we’ll keep it simple. To assess how blameworthy any factor is regarding the cause of a subsequent event, consider whether that element was 1) proximate 2) statistically valid 3) necessary and sufficient.

Consider the causes cited by those who’ve taken up the big lie. Take for example New York Mayor Michael Bloomberg’s statement that it was Congress that forced banks to make ill-advised loans to people who could not afford them and defaulted in large numbers. He and others claim that caused the crisis. Others have suggested these were to blame: the home mortgage interest deduction, the Community Reinvestment Act of 1977, the 1994 Housing and Urban Development memo, Fannie Mae and Freddie Mac, Rep. Barney Frank (D-Mass.) and homeownership targets set by both the Clinton and Bush administrations.

When an economy booms or busts, money gets misspent, assets rise in prices, fortunes are made. Out of all that comes a set of easy-to-discern facts.

Here are key things we know based on data. Together, they present a series of tough hurdles for the big lie proponents.

•The boom and bust was global. Proponents of the Big Lie ignore the worldwide nature of the housing boom and bust.

>

The housing boom and bust was global — Source: McKinsey Quarterly

>

A McKinsey Global Institute report noted “from 2000 through 2007, a remarkable run-up in global home prices occurred.” It is highly unlikely that a simultaneous boom and bust everywhere else in the world was caused by one set of factors (ultra-low rates, securitized AAA-rated subprime, derivatives) but had a different set of causes in the United States. Indeed, this might be the biggest obstacle to pushing the false narrative. How did U.S. regulations against redlining in inner cities also cause a boom in Spain, Ireland and Australia? How can we explain the boom occurring in countries that do not have a tax deduction for mortgage interest or government-sponsored enterprises? And why, after nearly a century of mortgage interest deduction in the United States, did it suddenly cause a crisis?

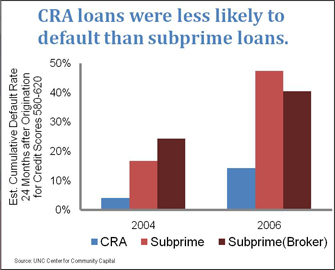

These questions show why proximity and statistical validity are so important. Let’s get more specific.The Community Reinvestment Act of 1977 is a favorite boogeyman for some, despite the numbers that so easily disprove it as a cause.It is a statistical invalid argument, as the data show.

For example, if the CRA was to blame, the housing boom would have been in CRA regions; it would have made places such as Harlem and South Philly and Compton and inner Washington the primary locales of the run up and collapse. Further, the default rates in these areas should have been worse than other regions.

>

CRA were less likely to default than Subprime Mortgages — Source: University of North Carolina at Chapel Hill

>

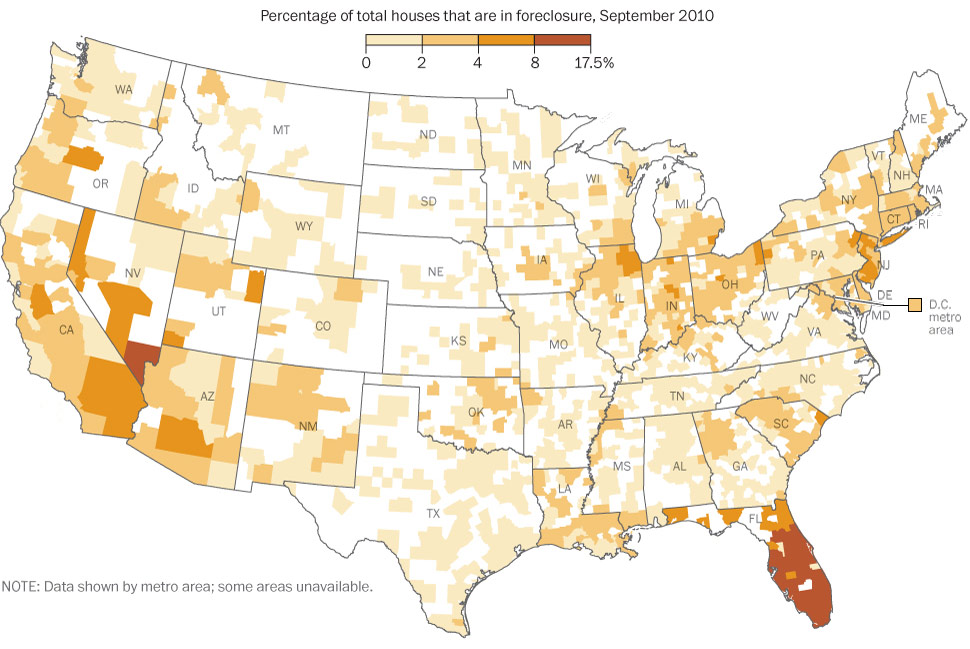

What occurred was the exact opposite: The suburbs boomed and busted and went into foreclosure in much greater numbers than inner cities. The tiny suburbs and exurbs of South Florida and California and Las Vegas and Arizona were the big boomtowns, not the low-income regions. The redlined areas the CRA address missed much of the boom; places that busted had nothing to do with the CRA.

>

Suburbs and Exurbs were where the boom & bust occurred — and not the CRA regions — Source: Washington Post

>

The market share of financial institutions that were subject to the CRA has steadily declined since the legislation was passed in 1977. As noted by Abromowitz & Min, CRA-regulated institutions, primarily banks and thrifts, accounted for only 28 percent of all mortgages originated in 2006.

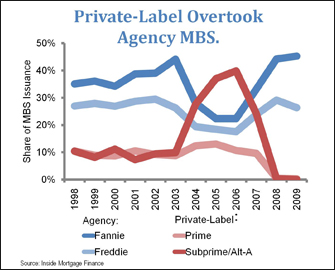

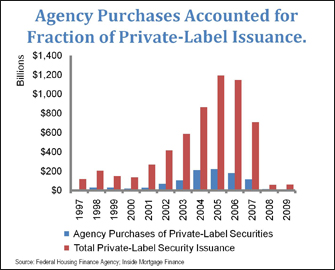

•Nonbank mortgage underwriting exploded from 2001 to 2007, along with the private label securitization market, which eclipsed Fannie and Freddie during the boom.

Check the mortgage origination data: The vast majority of subprime mortgages — the loans at the heart of the global crisis — were underwritten by unregulated private firms. These were lenders who sold the bulk of their mortgages to Wall Street, not to Fannie or Freddie. Indeed, these firms had no deposits, so they were not under the jurisdiction of the Federal Deposit Insurance Corp or the Office of Thrift Supervision. The relative market share of Fannie Mae and Freddie Mac dropped from a high of 57 percent of all new mortgage originations in 2003, down to 37 percent as the bubble was developing in 2005-06.

>

Nonbank mortgage underwriting exploded from 2001 to 2007, along with the private label securitization market, which eclipsed Fannie and Freddie during the boom — Source: University of North Carolina at Chapel Hill

>

•Private lenders not subject to congressional regulations collapsed lending standards. Taking up that extra share were nonbanks selling mortgages elsewhere, not to the GSEs. Conforming mortgages had rules that were less profitable than the newfangled loans. Private securitizers — competitors of Fannie and Freddie — grew from 10 percent of the market in 2002 to nearly 40 percent in 2006. As a percentage of all mortgage-backed securities, private securitization grew from 23 percent in 2003 to 56 percent in 2006

>

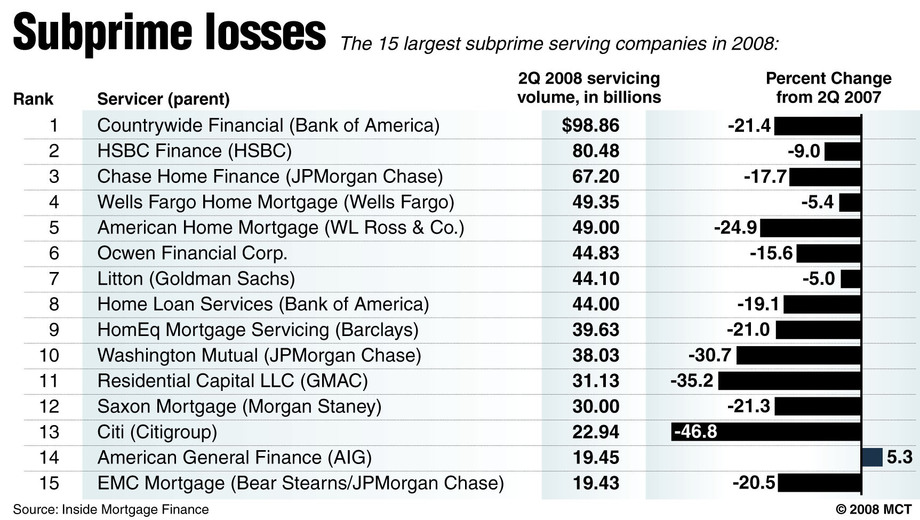

Subprime Lenders were (Primarily) Private

Only one of the top 25 subprime lenders in 2006 was directly subject to the housing laws overseen by either Fannie Mae, Freddie Mac or the Community Reinvestment Act — Source: McClatchy

>

These firms had business models that could be called “Lend-in-order-to-sell-to-Wall-Street-securitizers.” They offered all manner of nontraditional mortgages — the 2/28 adjustable rate mortgages, piggy-back loans, negative amortization loans. These defaulted in huge numbers, far more than the regulated mortgage writers did.

Consider a study by McClatchy: It found that more than 84 percent of the subprime mortgages in 2006 were issued by private lending. These private firms made nearly 83 percent of the subprime loans to low- and moderate-income borrowers that year. And McClatchy found that out of the top 25 subprime lenders in 2006, only one was subject to the usual mortgage laws and regulations.

A 2008 analysis found that the nonbank underwriters made more than 12 million subprime mortgages with a value of nearly $2 trillion. The lenders who made these were exempt from federal regulations.

>

Lenders made 12 million subprime mortgages with a value of nearly $2 trillion. Mortgage Companies and Thrifts NOT affiliated with CRA made 75% of Subprime Loans from 2004-07, Source: Orange County Register

>

A study by the Federal Reserve shows that more than 84 percent of the subprime mortgages in 2006 were issued by private lending institutions. The study found that the government-sponsored enterprises were concerned with the loss of market share to these private lenders — Fannie and Freddie were chasing profits, not trying to meet low-income lending goals.

>

Fannie and Freddie risky loan purchases was dwarfed by Private Label Securitization Source: University of North Carolina at Chapel Hill

>

Beyond the overwhelming data that private lenders made the bulk of the subprime loans to low-income borrowers, we still have the proximate cause issue. If we cannot blame housing policies from the 1930s or mortgage tax deductibility from even before that, then what else can we blame? Mass consumerism? Incessant advertising? The post-World War II suburban automobile culture? MTV’s “Cribs”? Just how attenuated must a factor be before fair-minded people are willing to eliminate it as a prime cause?

I recognize all of the above as merely background noise, the wallpaper of our culture. To blame the housing collapse that began in 2006, a recession dated to December 2007 and a market collapse in 2008-09 on policies of the early 20th century is to blame everything — and nothing.

~~~

Ritholtz is chief executive of FusionIQ, a quantitative research firm. He is the author of “Bailout Nation” and runs a finance blog, the Big Picture.

What's been said:

Discussions found on the web: