For the last few years we have been poking fun (hopefully in a good-natured way) at the book Stocks for the Long Run.

About halfway through this historic equity bull market, in 1994 to be exact, Dr. Jeremy Siegel first published Stocks for the Long Run. The Washington Post called it “one of the ten best investment books of all time.”

Dr. Siegel posited stocks are less risky than bonds as holding periods lengthen. The following table displays the relative frequency of stocks outperforming either bonds or Treasury bills as a function of holding period. Specifically, stocks outperformed bonds over a thirty-year holding period 100% of the time from 1871 to 1993. From 1802 to 1993 stocks outperformed 97.2% of the time. The only time other than the present when stocks underperformed bonds over 30 years was the 1840s.

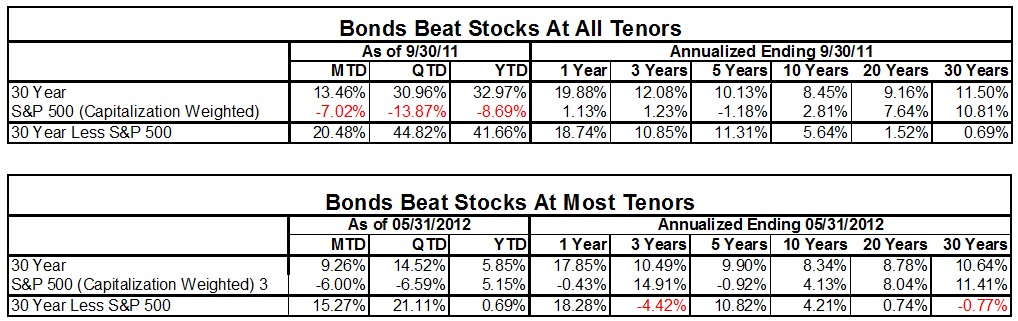

However, as the set of tables on the next page show, this trend has drastically changed in the wake of the financial crisis.

The first table shows returns through September 30, 2011. Bonds have completely dominated stocks over every tenor from one month to 30 years. Critics would say that September 30 is a favorable period for bonds as the all-time high in yields (low price) was September 30, 1981. This is true, but since the 1840s there have been numerous peaks in yields and none of those produced a bond outperformance over stocks as was seen since 1981.

So, to be fair, the second table below shows the most recent returns through May 31, 2012. Even when measured over this period, bonds still outperform stocks over most periods, only lagging at the 3-year and 30-year tenors.

According to Dr. Siegel’s book, this has not happened in hundreds of years and was never supposed to happen again.

Conclusion

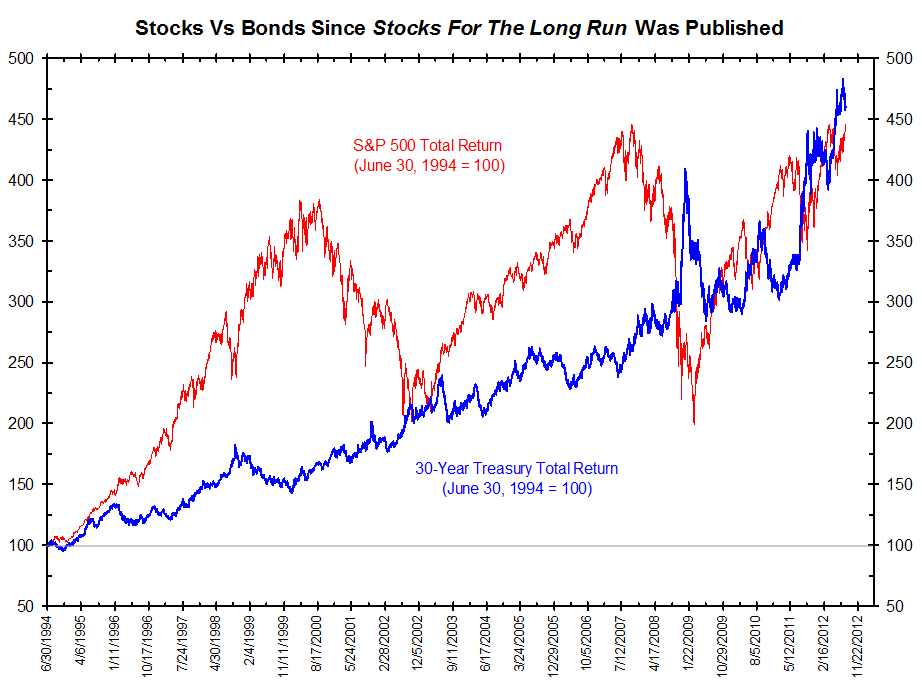

We have called this generation’s outperformance of bonds over stocks the biggest investment theme everyone has gotten wrong. Over the years, when we note this, many say this is the most bullish argument they have ever heard for stocks, as this trend has to reverse. However, as the tables above highlight, this argument has been made for years and been wrong for years.

Add Dr. Siegel to this list. His thesis was non-controversial in 1994 given the dogmatic belief returns increased with risk and stocks were a growth instrument while bonds were not. Events interceded. Now, in hindsight, we know that the biggest investment theme most missed over the last generation was the huge outperformance of bonds over stocks.

As the chart below shows, going against “one of the ten best investment books of all-time” has been a profitable idea.

It is really hard to identify a 160-year trend and write a book at the exact time it ends. Does that make Stocks for the Long Run the worst-timed investment book of all-time?

Previously:

Bonds for the Long Run (August 9th, 2012)

Stocks Oil, Gold, Bonds for the Long Run? (January 17th, 2011)

Bonds Beat Stocks: 1981-2011 (October 31st, 2011)

What's been said:

Discussions found on the web: