Over the last few weeks, we have discussed the questionable data and mediocre results of Jeremy Siegel’s Stocks for the Long Run (See this, this and this).

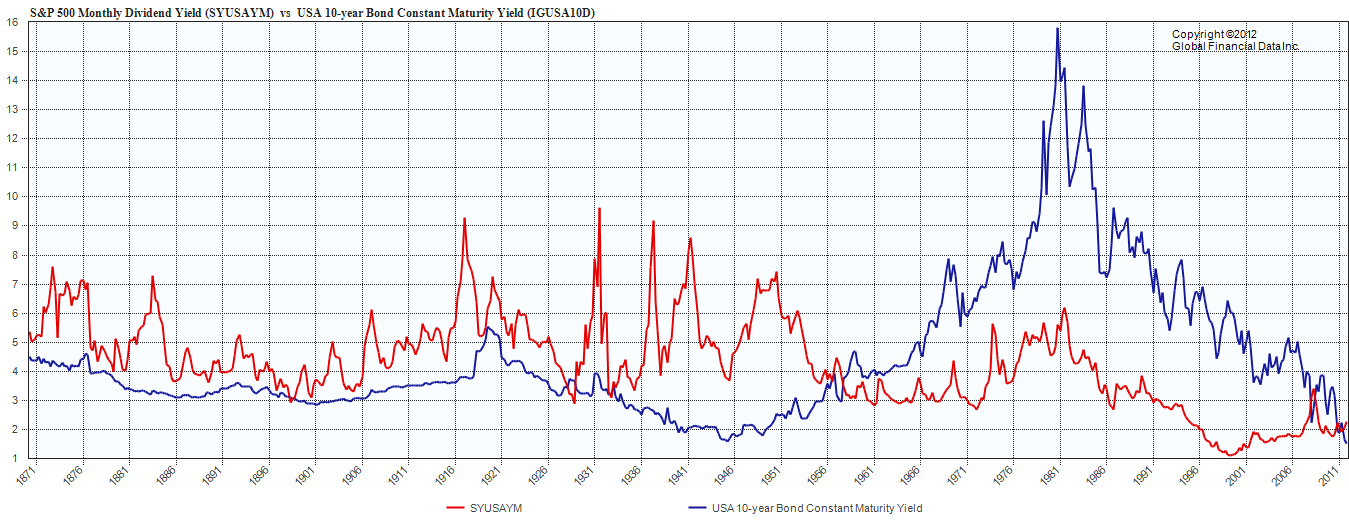

When we step back and take a look at The Really Long Run, we see a much clearer picture. The deep historical perspective as it pertains to the Dividend Yields on Equities vs Constant Yield on the 10 yr Bond may be revealing.

Equities have returned more from 1871 to 1956. An amazing 85 year outperformance run! After crossing over in ~1956, the 10 Year US Bond had a spectacular 56 year run of outperformance vs Equity Dividend Yield including all of the most recent bull runs.

Are Equities on the verge of another run of outperformance? (Note this is a very imprecise timing tool, measured in years and even decades, not nano seconds)

Equity Dividend Yield VS 10 Yr US Bond Constant Maturity Yield.

click for giant chart

Source: Global Financial Data

Thanks, Ralph !

Ralph Dillon rdillon@globalfinancialdata.com

What's been said:

Discussions found on the web: