click for a larger chart

Source: Bianco Research

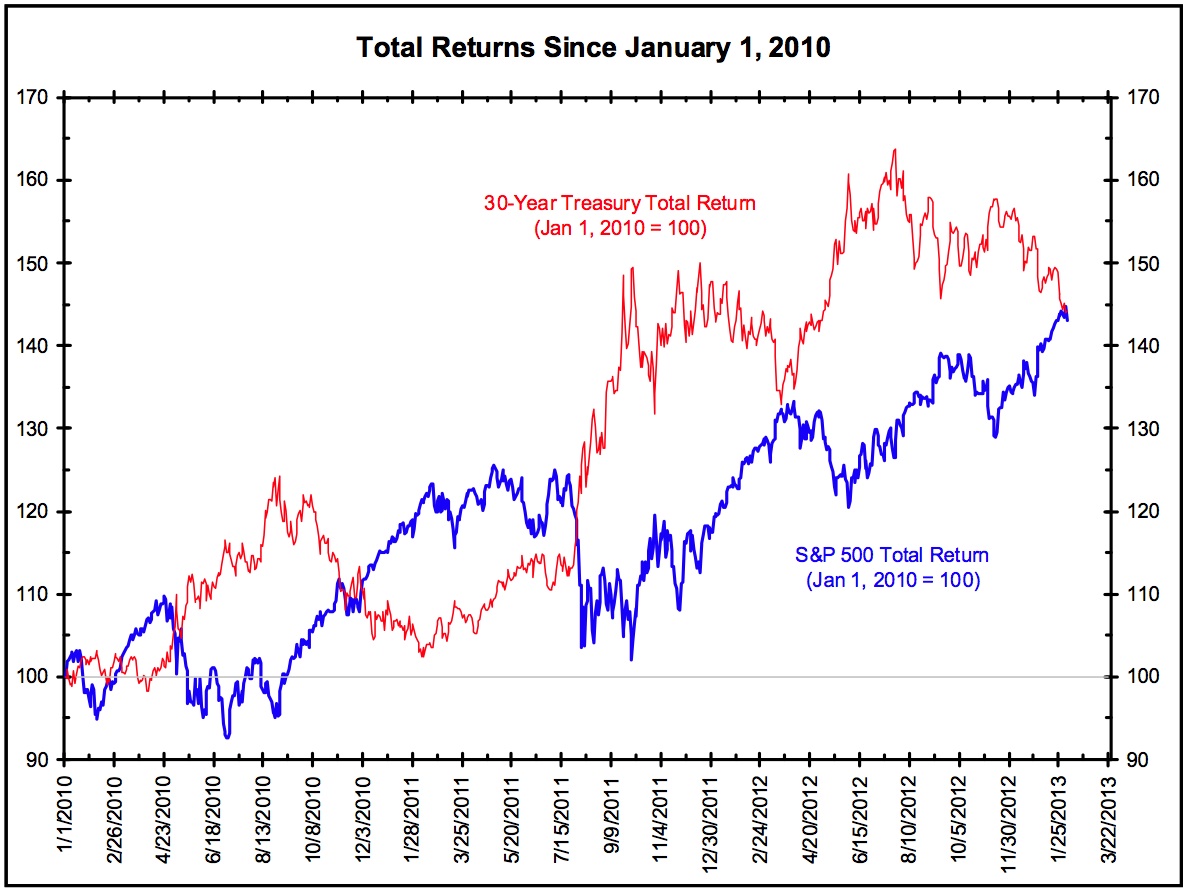

One of the things that this rally has managed to — finally — accomplish is that it has given stocks a (short term) performance advantage over bonds.

The two 2000s crash had made bonds the superior asset class for various time periods — the advantage was to fixed income for as long as 40 years.

Previously:

Bonds Beat Stocks: 1981-2011 (October 31st, 2011)

S&P500 Total Return vs Bonds 1800-2012 (September 12th, 2012)

Bonds for the Long Run (August 9th, 2012)

Stocks vs. Bonds (March 28th, 2009)

What's been said:

Discussions found on the web: