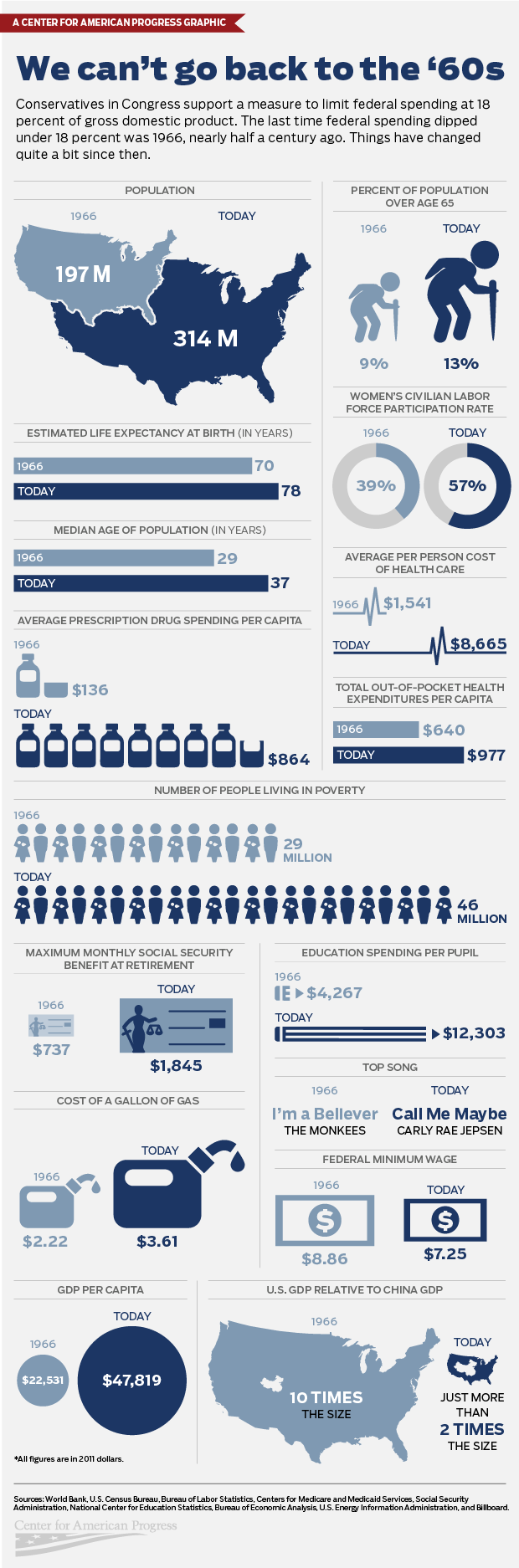

Via the Center for American Progress comes this neat infographic showing how the economics of the countryhas changed over the past 45 years:

click for ginormous graphic

Source: CAP

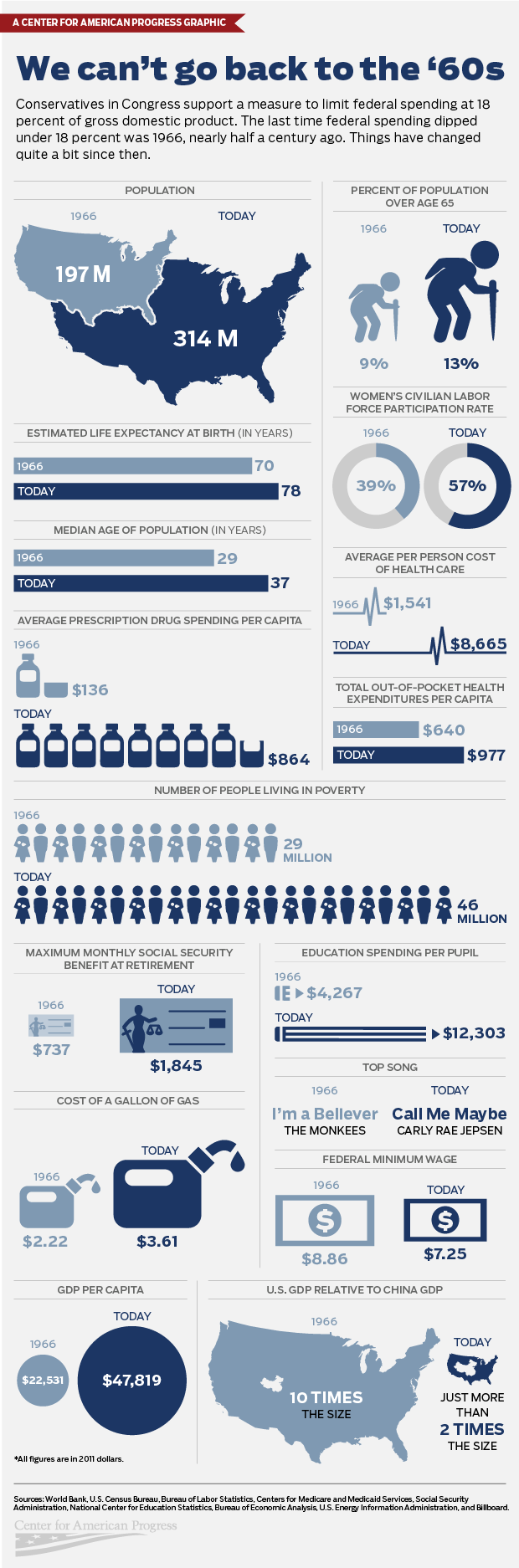

Via the Center for American Progress comes this neat infographic showing how the economics of the countryhas changed over the past 45 years:

click for ginormous graphic

Source: CAP

Get subscriber-only insights and news delivered by Barry every two weeks.

What's been said:

Discussions found on the web: