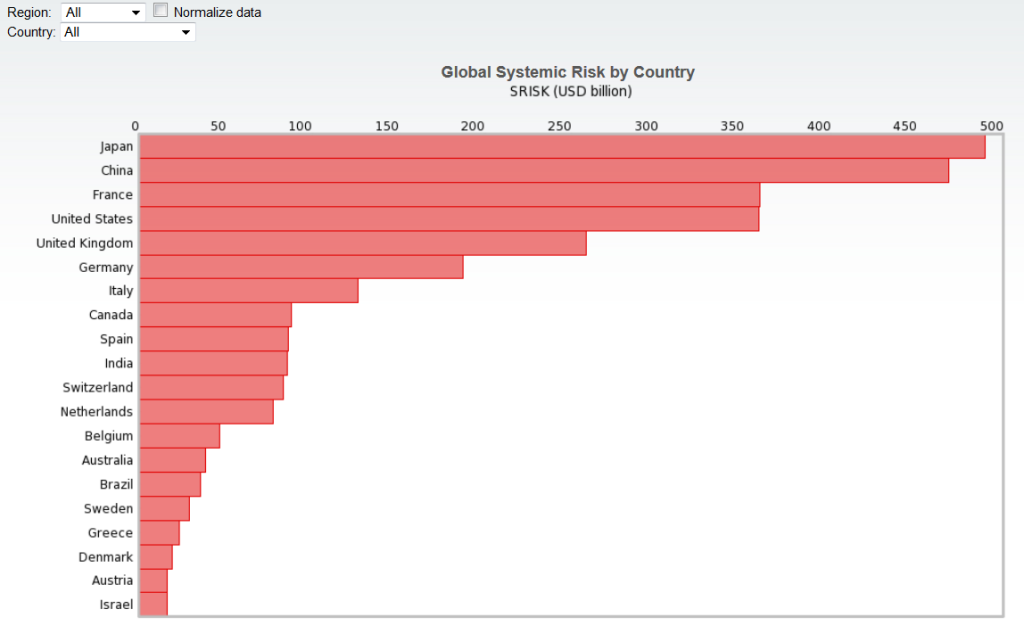

click for ginormous graphic

Source: NYU VLAB

I mentioned NYU’s VLAB earlier, but one more trick I wanted to share:

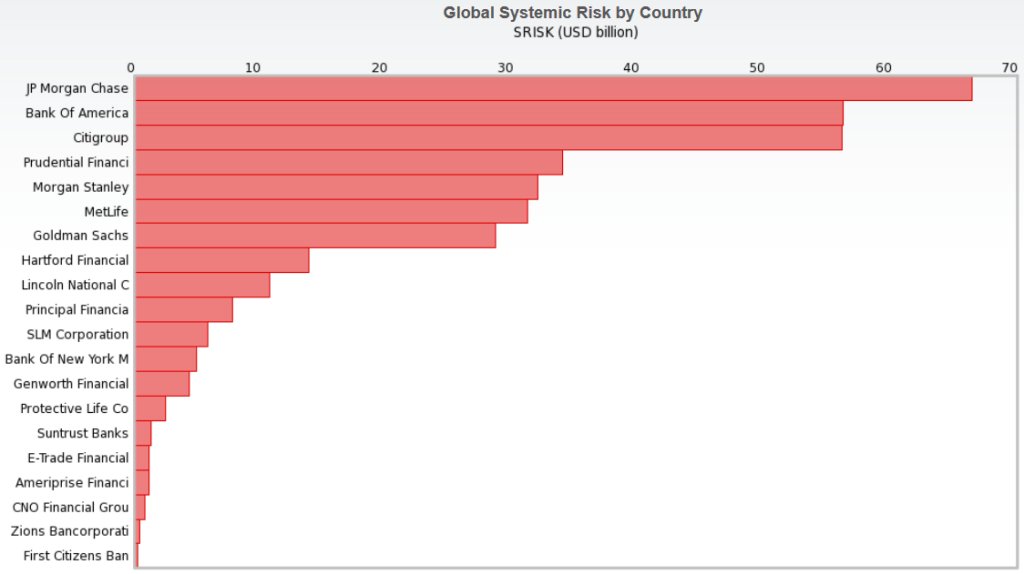

You can drill down by region or even country to see how much risk is in the system. Note that this is a function of both size and riskiness, i.e., a very small reckless country presents less of a risk than a very large moderately risk-taking nation.

click for ginormous graphic

Source: NYU VLAB

What's been said:

Discussions found on the web: