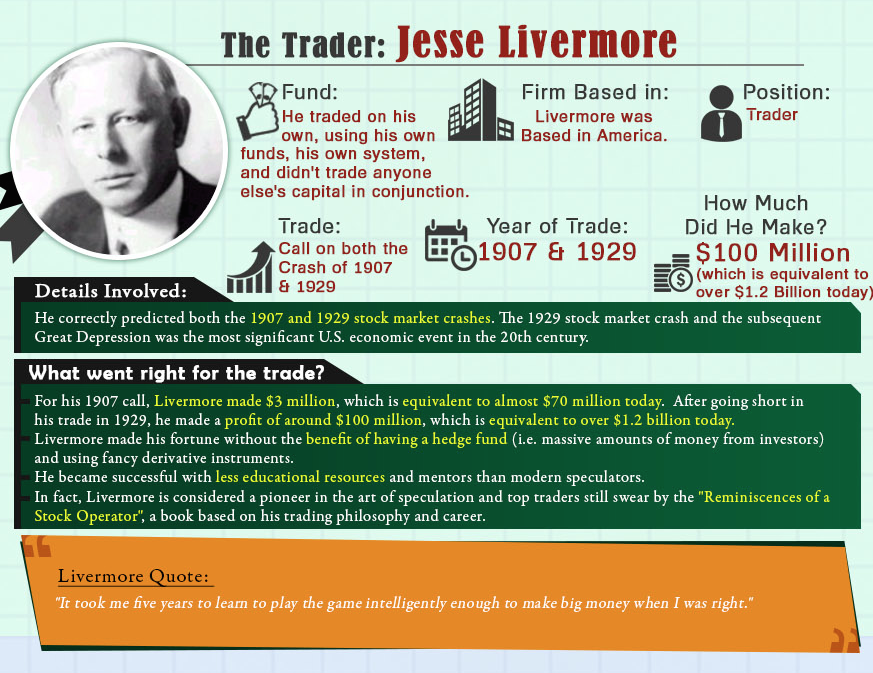

Nice graphic showing the 10 greatest — and worst — trades of all time. The lure of these outsized billion dollar wins seems to affect the psychology of many investors and traders, looking for that one giant score.

click for full infographic

Source: 888 Markets

This is a huge data set — click (and then again) to see the full size graphic.

What's been said:

Discussions found on the web: