“If you’re bullish and wrong, you usually have plenty of company. But if you’re bearish and wrong, it’s almost unforgivable.”

-Bob Kargenian, TABR Capital Management, Barron’s DECEMBER 15, 2012

The above quote from Barron’s has been on my mind for a while. I thought of it again as the markets have made a series of new highs, and the bear community has been split. Some have been “forced in,” while others have doubled down.

The context of the above was a letter to Barron’s in response to a December 1st 2012 Abelson commentary that stated “why money manager John Hussman is very bearish on stocks” (“A Real Cliff Hanger,” Up & Down Wall Street, Dec. 3)

There is an intricate set of issues here, but I want to focus on three aspects: 1) Psychology, 2) Error admission & correction, and 3) why “Other People’s Money” (OPM) agency issue is not present or understood by the commentariat — those ministers without portfolio who are the background noise to the market.

Since this rally began in March 2009, it has been disliked. I was a kid in 1973-74, so I have no firsthand recollection of how the crowd responded to the 76% bounce-back rally. 1933 was way before my time. Perhaps there was a touch of hyperbole when, back in 2009, I wrote this was the Most Hated Rally in Wall Street History®. I wasn’t present for these other similar crash bouncebacks, but I suspect the psychology was the same. Dispirited traders suffering from recency effects were overly impacted by memories of the crash. The rally left these frightened folks behind.

That emotional cognitive bias has prevented many from recognizing the turn or even committing in a small way to having upside exposure. There are a great many reasons why the rally should not continue, and why it will end badly. There certainly are plenty of things to be concerned about. However, what makes investing in markets so different from other forms of intellectual debate is that we regularly get a resolution to the different arguments via market returns. We may have different timelines, and the daily action is essentially noise, but we do get a resolution. Each month, each quarter, each year, we see which argument was more pragmatically correct in terms of the outcome of various risk assets. Their progress, or lack thereof, is the ultimate adjudicator.

This is not to say that markets are never wrong — they are often wrong, and can stay that way for extended periods of time. However, beyond the psychology we discussed above (and ad nauseum elsewhere), there comes a point were you must admit error, reverse your position, and move on.

This is where the quote above comes in. If you are running OPM, you cannot miss a 145% move to the upside. The classic quote on this is “If you are bullish and wrong, your clients are angry at you. If you are bearish and wrong, they fire you.” (I wish I knew the original source for this!)

Hence, our agency issue. This is what is meant by “Forced in” — managers running real assets cannot sit idly by on the sidelines. Eventually, they either buy in or lose so much in AUM that they have effectively been fired. This is why having some form of self-analysis to a) examine when you are wrong; b) be able to determine why; and then c) reverse your position . . . is so crucial to anyone who is an investor (professional or amateur).

The exceptions are the Ministers without Portfolio. These are the talking heads, the pundits and strategists who can carve out an intellectual position that proves to be wildly wrong. And they can do so without incurring a penalty, an angry client phone call or a firing.

Think about who is on TV and/or spilling pixels on the OpEd pages lately. The People who have been wrong on everything from Equities to Bonds to the Dollar to Gold to Apple (AAPL) and back again. How is it this parade of wrong way Riegels manages to keep showing up again and again to blather about whatever it is they are wrong about this time? Why is there zero accountability?

The answer is surprisingly simple: Its not a bug, its a feature. They are in the infotainment business, not the asset management business. Hence, being wrong, albeit entertainingly, is part of their jobs.

I started as a trader, moved to research, eventually coming back around as a money manager. I can tell you first hand that being eventually right — Dow 6800, anyone? — only works if your are on the sidelines yelling at the players. Your obligations completely change once you step onto the field of battle. When you are responsible for people’s portfolios, your role must change.

Note too, that this is not a Chuck-Prince-dance-when-the-music-is-playing scenario. As a CEO, his misaligned compensation encouraged him to dance right to the edge of the cliff. Some of us clearly put forward compelling analyses as to why that Housing/Derivatives/Subprime cycle was doomed.

Which brings me back to the present market. What we are dealing with today is a case of first impression — massive credit crisis and collapse, followed by massive Fed intervention. We don’t know how this plays out, as we have never seen anything quite like this in history. Can the Fed simply wait it out, and let $4 trillion in bonds to mature without rolling over? I have no idea, but neither do the folks insisting it ends with us living in a post-apocalyptic Mad Max era.

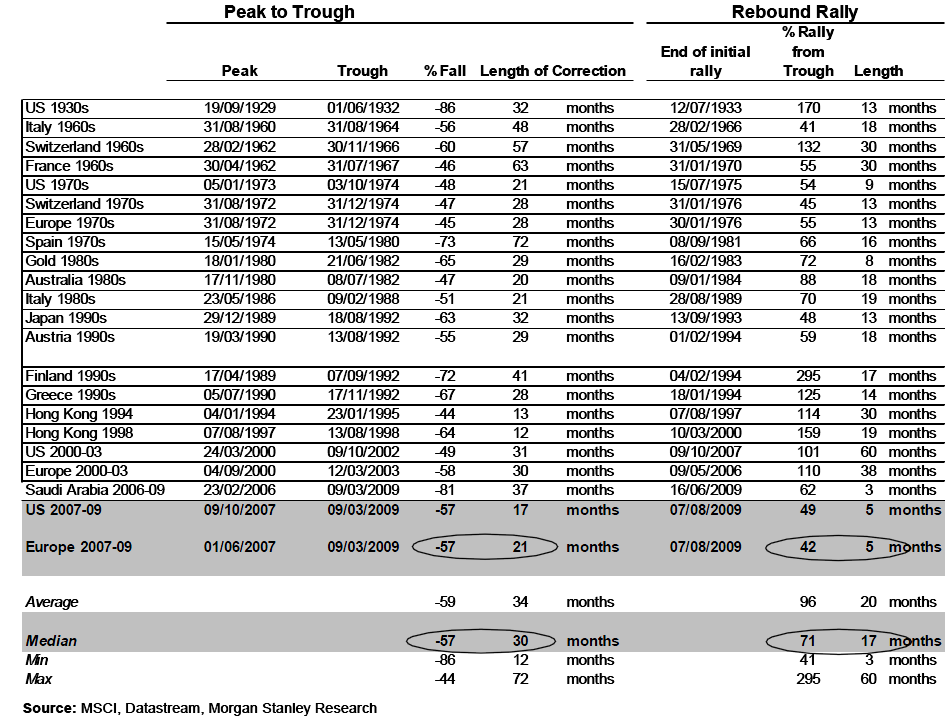

Just like every other cycle, one day, this bull market will end. I cannot tell you if its next Tuesday or sometime in 2019. The average (See first table below) is 3.8 years. We are now at 4.1 years. But the range is much broader, as both tables below makes clear.

There are many silly reasons for being either all in — or all out — of the markets. The bottom line is that you should have a firm grasp on your own investment posture, risk tolerances and financial goals. You should understand how we got here and why. Make sure you have some form of your own coherent plan. But if you are waiting for someone else on TV to tell you what to do, whether its Jim Cramer or David Tepper or even lil’ ole Me, then you have yourself a big problem.

There is asset management, and there is infotainment, and never the twain shall meet.

Previously:

Looking at the Very Very Long Term (November 6th, 2003)

Four Stages of Secular Bear Markets (August 27th, 2009)

The Most Hated Rally in Wall Street History (October 8th, 2009

Bull Market Durations (January 15th, 2013)

Is the Secular Bear Market Coming to an End? (February 4th, 2013)

Table: Secular Bear Markets and Subsequent Rebound Rally:

>

What's been said:

Discussions found on the web: